On 23 February, Norwegian announced the launch of transatlantic flights from five cities in the UK and Ireland, including Belfast, Cork, Dublin, Edinburgh and Shannon.

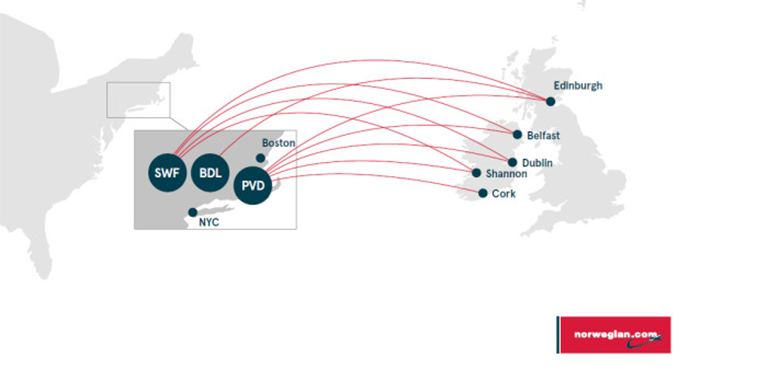

If it wasn’t a market disruptor already, Norwegian’s announcement on 23 February that it was launching transatlantic flights from five cities in the UK and Ireland, will have had the CEOs at the US Big Three (USB3) – American Airlines, Delta Air Lines and United Airlines – reaching (again) for the speed-dial button to President Trump’s office on their phones about this noisy European LCC. Launching 38 new weekly services from Belfast International, Cork, Dublin, Edinburgh and Shannon airports, in total, it will launch 10 new transatlantic routes this summer, all operated by Norwegian’s 189-seat 737 MAX 8 aircraft.

Belfast International (BFS) – five flights per week:

- Stewart (SWF – for New York) – three times weekly flights (Tuesdays, Thursdays, Saturdays). Departs Belfast International at 16:20; arrives Stewart at 19:05; starts 1 July;

- Providence (PVD – for Boston) – twice-weekly flights (Tuesdays, Saturdays). Departs Belfast International at 15:45; arrives Providence at 18:20; starts 1 July.

Cork (ORK) – three flights per week:

- Providence – three times weekly flights (Tuesdays, Thursdays, Saturdays). Departs Cork at 16:20; arrives Providence at 19:05; starts 1 July.

Dublin (DUB) – 12 flights per week:

- Stewart – daily flights. Departs Dublin at 16:00 (flights on Tuesdays, Wednesdays depart at 15:55, flights on Thursdays and Fridays depart at 15:45); arrives Stewart at 19:00; starts 1 July;

- Providence – five times weekly flights (Mondays, Wednesdays, Thursdays, Fridays, Sundays). Departs Dublin at 15:45; arrives Providence at 18:35; starts 1 July from Providence.

Edinburgh (EDI) – 14 flights per week:

- Stewart – daily flights. Departs Edinburgh at 17:15; arrives Stewart at 20:00; starts 15 June;

- Providence – four times weekly flights (Mondays, Wednesdays, Fridays, Sundays). Departs Edinburgh at 17:30; arrives Providence at 20:10; starts 16 June;

- Hartford (BDL – New England/Connecticut) – three times weekly flights (Tuesdays, Thursdays, Saturdays). Departs Edinburgh at 17:40; arrives Hartford at 20:20; starts 17 June.

Shannon (SNN) – four flights per week:

- Stewart – twice-weekly flights (Wednesdays, Sundays). Departs Shannon at 16:00; arrives Stewart at 18:45; starts 1 July from Stewart;

- Providence – twice-weekly flights (Mondays, Fridays). Departs Shannon at 16:25; arrives Providence at 18:55; starts 2 July from Providence.

Six aircraft required to fly the schedule

With 38 weekly flights to cover, Norwegian will need up to six aircraft to operate the flying programme from early July when the Irish and Northern Irish flights commence. There is a tiny piece of slack in the schedule below, with the possibility of the airline adding two more rotations from Stewart, perhaps to another European destination. There are even gaps in the flying programme that will be utilised for 737 MAX 8 services within Europe, as Norwegian intends to use the aircraft on its existing Edinburgh to Oslo Gardermoen flights four times weekly from W17/18 in a period of downtime between US services.

Straight in at #2 in Scotland

Looking ahead to the US market competitive landscape in S17, the addition of double-daily operations from Edinburgh will certainly have a marked impact on the incumbents, primarily the USB3. Prior to Norwegian’s arrival in Scotland (Edinburgh and Glasgow are the only airports which have US services), the USB3 would have commanded 89% of weekly capacity this summer. With the LCC’s schedule now clear, this share drops to 71% of the expanded market size.

Norwegian’s capacity will add 25% more seats to the US this summer from Scotland’s airports, a sizeable increase which will be great for passengers wanting to get to the New York and Boston regions, but probably very detrimental to airline profits on these routes. United has perhaps the most to lose, as it operates double-daily services from New York Newark to Edinburgh and daily services to Glasgow in the peak season (w/c 14 August 2017), as well as daily flights from Chicago O’Hare to Edinburgh. Next most-exposed to the market disruptor’s arrival is Delta, which plans to offer a daily New York JFK route to both airports in S17. American (daily Philadelphia and JFK services), Virgin Atlantic Airways (twice-weekly Orlando) and Thomson Airways (Orlando Sanford) will perhaps have less to fear from Norwegian’s incursion into this market at this initial stage.

Aer Lingus and USB3 rule in Ireland-US market

The introduction of Norwegian into the Ireland-US market pair is likely to be less disruptive than the situation in Scotland. The LCC’s 3,591 weekly seats will add just 7% more seats to the US this summer. Prior to Norwegian’s arrival in Ireland, Aer Lingus would have controlled 50% of weekly capacity to the US in S17. With the LCC’s plans now public knowledge, the oneworld carrier’s share drops to 47% of the expanded market size.

Cork will become the third Irish airport to have US services, joining Dublin and Shannon. In terms of US cities with an Irish route, this will rise from 12 to 14 as a result of Stewart and Providence airports being added when Norwegian begins its operations in July. Incidentally, this will increase to 15 on 1 September when Aer Lingus adds Miami to its US route network.

A brief review of the US-Northern Ireland market reveals that despite a £9m (€11m) rescue package to save United’s Newark to Belfast International service, the route, Northern Ireland’s only direct service to the US, was terminated in early January this year. So no doubt the arrival of Norwegian less than six months later will be some relief to the country’s busiest airport.

Norwegian already operates low-cost flights to eight US cities from London Gatwick– the addition of new routes to three smaller US airports offers even greater choice to passengers in other parts of the UK and Ireland.